With Compliance risk management at the forefront, navigating the intricate landscape of business operations takes on a whole new dimension. This vital aspect not only protects organizations from legal pitfalls but also fosters an environment where innovation can thrive amidst regulatory frameworks. As businesses evolve, understanding the nuances of compliance risk becomes crucial for sustainable success.

Compliance risk management entails identifying, assessing, and mitigating risks tied to regulatory requirements. It’s an essential strategy for businesses operating in today’s complex global landscape, ensuring they adhere to laws while maintaining ethical standards. From safeguarding consumer data to fostering trust within professional networks, compliance plays a pivotal role in shaping business practices.

Overview of Compliance Risk Management

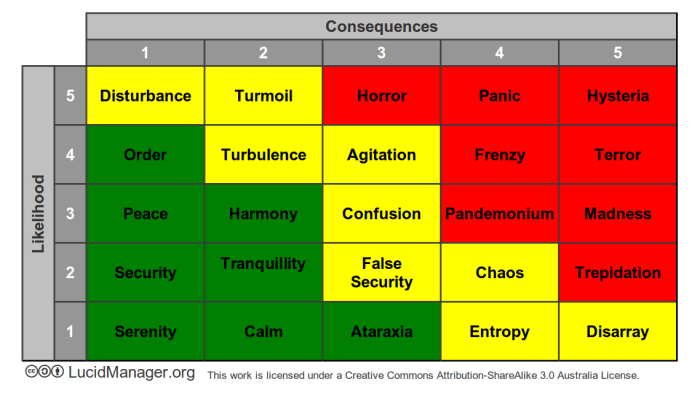

Compliance risk management refers to the process that organizations implement to ensure adherence to laws, regulations, and internal policies that govern their operations. The importance of compliance risk management in business operations cannot be overstated, as it safeguards the company from legal penalties, financial losses, and reputational damage. A well-structured compliance framework not only protects the organization but also enhances its credibility and integrity in the marketplace.Key components of an effective compliance risk management strategy include risk identification, assessment, and mitigation.

Organizations must identify potential compliance risks, assess their likelihood and impact, and devise strategies to mitigate these risks. Additionally, a strong compliance culture, continuous monitoring, and employee training are critical to the success of compliance efforts. Common compliance risks faced by businesses today include data privacy violations, anti-money laundering issues, and regulatory compliance failures, all of which can have severe consequences for organizations.

Role of Compliance Risk Management in Business Innovation

Compliance risk management significantly influences business innovation efforts. Organizations that proactively manage compliance risks are more likely to explore innovative solutions, as they understand the regulatory landscape and can navigate it effectively. For instance, companies like Airbnb and Uber have integrated compliance measures into their business models, allowing them to innovate while adhering to legal standards.Balancing regulatory requirements with creative solutions is essential to fostering innovation.

It encourages companies to think outside the box while ensuring they remain compliant with relevant regulations. For example, when launching new products or services, organizations can engage in thorough compliance assessments to identify potential risks early in the development process, allowing them to address these concerns proactively.

Compliance Risk Management in International Business

Managing compliance risks in a global context presents unique challenges. Different jurisdictions have varying regulatory requirements, which can complicate compliance efforts for multinational companies. This often necessitates a tailored approach, taking into account local laws and cultural practices.To effectively manage compliance risks across different jurisdictions, organizations should adopt a comprehensive compliance program that standardizes processes while allowing for local adaptations.

A crucial element of this strategy is understanding the cultural factors that influence compliance practices internationally. For instance, in some cultures, personal relationships may play a significant role in business transactions, impacting how compliance is perceived and enacted.

Conducting Business Interviews with a Compliance Focus

When interviewing candidates about their compliance awareness, organizations should create guidelines that assess not only their knowledge of regulations but also their ability to apply this knowledge in real-world scenarios. This involves posing questions that gauge their understanding of compliance issues relevant to the specific role they are applying for.The importance of compliance knowledge varies across job roles. For example, positions in finance and operations may require a deep understanding of regulatory compliance, while roles in marketing may focus more on consumer protection laws.

To test candidates’ understanding of compliance risks, organizations can present them with hypothetical scenarios that require them to identify potential compliance pitfalls and suggest solutions.

Job Search Techniques for Compliance Professionals

For careers in compliance, key skills and qualifications include a strong understanding of regulatory frameworks, analytical abilities, and excellent communication skills. Familiarity with compliance tools and software can also be beneficial.Tailoring resumes to highlight compliance experience is crucial for job seekers in this field. Candidates should emphasize specific achievements related to compliance initiatives, such as successful audits or risk assessments.

Networking strategies specifically for compliance job seekers include attending industry conferences, joining compliance-related professional organizations, and engaging in online forums where compliance issues are discussed.

Compliance in Business Management Practices

Integrating compliance risk management into business management practices is essential for any organization. This involves embedding compliance considerations into everyday decision-making processes and ensuring that all employees understand their roles in maintaining compliance.Leadership plays a pivotal role in fostering a culture of compliance within an organization. Leaders must model compliant behavior and actively promote a compliance-first approach. To assess compliance effectiveness within management practices, organizations can conduct regular audits, gather employee feedback, and review compliance training outcomes.

Marketing Direct with Compliance Considerations

In direct marketing strategies, compliance-related challenges often arise, especially concerning data protection and consumer privacy policies. Companies must ensure that their marketing initiatives comply with regulations such as the General Data Protection Regulation (GDPR).Successful compliance-focused marketing campaigns often demonstrate transparency and responsibility in handling consumer data. For example, companies that prioritize consumer consent in their marketing efforts can build trust and enhance their brand reputation.

Protecting consumer data is paramount, as breaches can lead to significant legal and financial repercussions.

Business Networking and Compliance Awareness

Building a network focused on compliance issues involves creating connections with professionals who share an interest in compliance matters. Engaging in discussions about compliance at networking events can help individuals stay informed about industry trends and best practices.Establishing trust within a professional network is crucial, as compliance is deeply intertwined with ethics and integrity. Networking opportunities can arise at industry conferences, workshops, or local meetups where compliance topics are discussed.

Outsourcing and Compliance Risk Management

Outsourcing compliance functions can introduce several risks, including the potential for lapses in compliance oversight. Organizations must carefully assess these risks and establish clear expectations and monitoring mechanisms for outsourced compliance functions.Strategies for managing compliance when outsourcing include conducting thorough due diligence on vendors, establishing compliance clauses in contracts, and regularly assessing vendor compliance through audits. Vendor compliance assessments are essential to ensure that third parties adhere to the same standards as the organization.

Effective Business Presentations on Compliance Topics

When presenting compliance topics to stakeholders, a structured approach is vital. Organizers should begin with a clear Artikel, focusing on key compliance issues, implications, and recommended actions.Visualizing compliance data effectively in presentations can enhance understanding and engagement. Utilizing charts, graphs, and infographics can help communicate complex information more clearly. Engaging the audience on compliance issues requires interactive elements, such as Q&A sessions or live polls, to encourage participation and discussion.

Enhancing Business Productivity Through Compliance

The relationship between compliance and business productivity is significant. Streamlining compliance processes can help reduce bureaucratic hurdles, allowing teams to focus on their core business objectives.Methods to enhance compliance efficiency include leveraging technology to automate compliance tasks, conducting regular training sessions to keep employees informed, and adopting a risk-based approach to compliance management. Technology plays a crucial role in facilitating compliance, with tools that help monitor and analyze compliance data effectively.

Compliance Risks in the Restaurant Industry

The restaurant industry faces unique compliance risks, particularly regarding health and safety regulations. Compliance with food safety standards, employee health regulations, and licensing requirements is critical to operating successfully.Strategies for addressing health and safety compliance in restaurants include implementing regular training for staff, conducting routine audits, and fostering a culture of safety and compliance. Case studies of restaurants that have successfully managed compliance risks often highlight the importance of proactive measures and robust training programs.

Writing Resumes and Cover Letters for Compliance Roles

A compliance-focused resume should highlight relevant experience, certifications, and skills that align with the requirements of the role. Including specific compliance-related achievements, such as successful audits or risk management projects, can set candidates apart.Key phrases and terms to include in cover letters for compliance positions may involve references to regulatory knowledge, risk assessment capabilities, and experience in compliance training. Standout resumes in the compliance field typically demonstrate a clear understanding of compliance challenges and a record of effectively addressing them.

Retail Business Compliance Strategies

The retail sector faces specific compliance risks, including issues related to consumer protection, data privacy, and product safety. Implementing best practices for maintaining compliance in retail operations is essential for success.Training programs for retail staff should focus on compliance awareness, equipping employees with the knowledge needed to identify and handle compliance issues. Effective compliance training programs often involve interactive learning methods, such as role-playing and scenario-based exercises, to reinforce key concepts.

Comprehensive Risk Management Frameworks

A robust risk management framework comprises several components, including risk identification, assessment, mitigation, and monitoring. Organizations that implement comprehensive frameworks can better navigate compliance challenges and reduce potential exposure to risks.Successful risk management implementations often involve collaboration across departments and regular reviews of risk management practices. Compliance is an integral part of overall risk management strategies, ensuring that organizations remain vigilant in their compliance efforts.

Sales Management and Compliance Integration

Compliance considerations are crucial in sales strategies, as regulatory requirements can significantly impact how products and services are marketed. Training sales teams on compliance is essential to ensure adherence to these regulations.Examples of compliance-focused sales performance evaluations might include assessing how well sales strategies align with compliance requirements or how effectively team members handle compliance-related objections from clients.

Enhancing Sales Training with Compliance Focus

Creating a training module that incorporates compliance topics for sales staff is vital for fostering a compliant sales culture. Training sessions should cover relevant regulations, ethical selling practices, and compliance responsibilities.Reinforcing compliance during sales training sessions can involve using real-world examples and case studies to illustrate compliance issues. Ongoing compliance education for sales professionals is crucial to ensure they remain updated on regulatory changes and best practices.

Ensuring Business Security Through Compliance

The connection between compliance and business security measures is significant, as compliance requirements often dictate the protocols for safeguarding sensitive business information. Organizations must adhere to regulations such as the Health Insurance Portability and Accountability Act (HIPAA) or the Payment Card Industry Data Security Standard (PCI DSS) to ensure compliance.Strategies for ensuring cybersecurity compliance include conducting regular security audits, implementing access controls, and providing ongoing training to employees on data protection best practices.

Compliance Challenges for Small Businesses

Small businesses often encounter compliance pitfalls due to limited resources and expertise. Common challenges include understanding regulatory requirements and implementing effective compliance programs.Affordable strategies for achieving compliance in small enterprises may involve leveraging online resources, joining industry associations for guidance, and using compliance management software. Examples of small businesses that effectively manage compliance often showcase creativity and resourcefulness in addressing compliance challenges.

Compliance for Solo Professionals

Solo professionals have specific compliance responsibilities that may vary based on their field. Understanding these obligations is essential to avoid potential legal issues.A checklist for solo practitioners can include items such as maintaining proper licenses, ensuring data privacy, and adhering to relevant industry regulations. Resources available for solo professionals seeking guidance on compliance may involve professional organizations and online compliance toolkits.

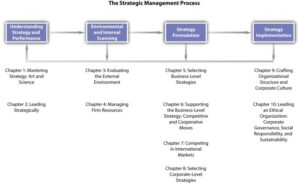

Strategic Planning with Compliance in Mind

Incorporating compliance into the strategic planning process ensures that organizations align their goals with regulatory requirements. This proactive approach minimizes risk while supporting business growth.Examples of strategic goals aligned with compliance objectives may include enhancing data protection measures or improving transparency in reporting. Benefits of proactive compliance planning often include reduced risk exposure and a stronger organizational reputation.

Team Building Activities Focused on Compliance Awareness

Team-building exercises that emphasize compliance education can foster a culture of compliance within organizations. Activities may include compliance-themed workshops, role-playing scenarios, or group discussions on ethical dilemmas.Teamwork is essential in achieving compliance goals, as collaborative efforts can lead to more robust compliance practices. Success stories of companies that improved compliance through team-building initiatives often highlight the positive impact of shared learning experiences.

Venture Capital and Compliance Risk Management

Startups seeking venture capital must consider compliance risks associated with their business models. Investors often assess compliance risks as part of their due diligence process, as regulatory issues can significantly impact the viability of an investment.Strategies for startups to demonstrate robust compliance practices may include establishing clear compliance policies, engaging in regular training, and maintaining transparency with investors regarding compliance efforts.

Workplace Communication and Compliance Culture

Workplace communication plays a vital role in fostering a compliance culture. Clear communication about compliance expectations, policies, and procedures helps ensure that employees understand their responsibilities.Methods to improve communication about compliance issues can include regular compliance newsletters, dedicated intranet sections, and open forums for discussing compliance concerns. Effective compliance communication strategies often involve creating an environment where employees feel comfortable raising compliance-related questions.

Ensuring Workplace Safety Through Compliance

Compliance obligations related to workplace safety regulations are critical to protecting employees and minimizing legal liabilities. Organizations must adhere to regulations set forth by agencies such as the Occupational Safety and Health Administration (OSHA).Strategies for training employees on safety compliance involve providing hands-on training, conducting safety drills, and regularly reviewing safety policies. Case studies of successful workplace safety compliance initiatives often showcase the importance of a proactive safety culture in preventing incidents.

Conclusion

In summary, compliance risk management is not merely a regulatory obligation but a strategic advantage that can drive innovation and build trust within the marketplace. By prioritizing compliance, businesses not only shield themselves from risks but also create a culture that encourages responsible growth. As we look ahead, companies that embrace compliance as a core component of their operations will undoubtedly lead the way in their respective industries.

Popular Questions

What are the key components of compliance risk management?

The key components include risk identification, risk assessment, mitigation strategies, monitoring, and reporting.

How does compliance risk management benefit innovation?

It enables businesses to innovate within a safe framework, balancing creativity with regulatory adherence.

What common compliance risks do businesses face?

Common risks include data breaches, regulatory non-compliance, and ethical misconduct.

Why is compliance important in international business?

Compliance is crucial to navigate varying regulations across jurisdictions and to avoid legal penalties.

How can small businesses manage compliance effectively?

Small businesses can achieve compliance by implementing affordable strategies, prioritizing training, and leveraging technology.