Outsourcing finance functions sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. By leveraging external expertise, businesses can optimize their financial operations, reduce costs, and focus on core activities, making outsourcing a strategic choice for organizations across various industries.

This practice not only encompasses a wide range of financial tasks—from accounting and payroll to tax preparation—but also highlights its growing importance in today’s fast-paced business landscape, where efficiency and innovation are paramount.

Understanding Outsourcing Finance Functions

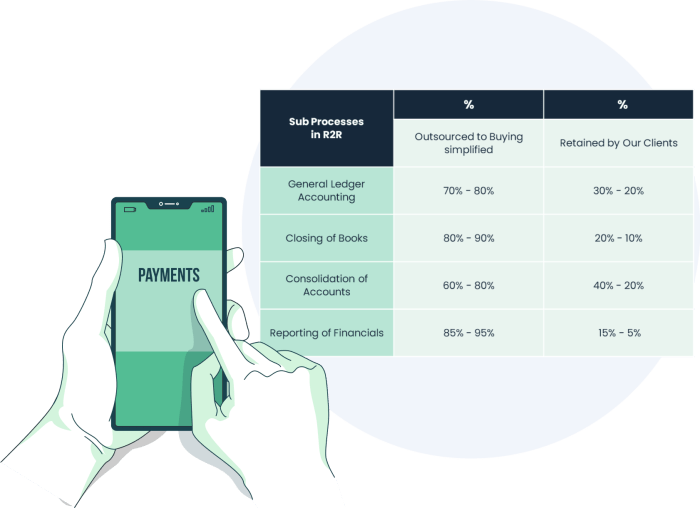

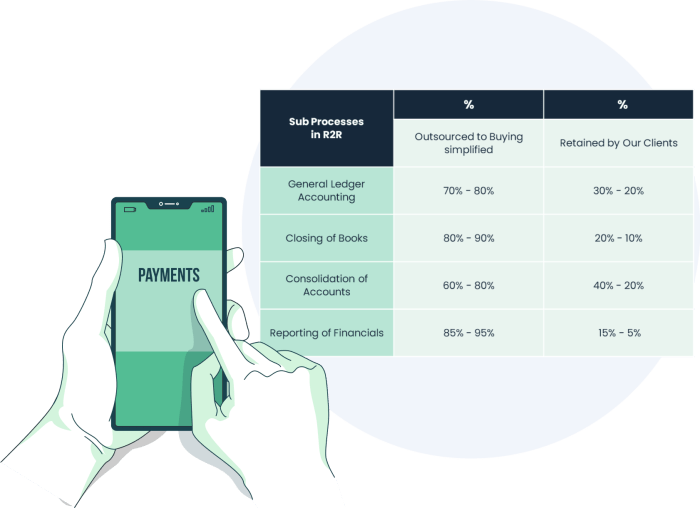

Outsourcing finance functions involves delegating specific financial tasks to third-party service providers. This approach is gaining traction among businesses as it allows them to streamline their operations and focus on core competencies. Finance outsourcing is significant because it enables organizations to access specialized expertise, reduce costs, and enhance operational efficiency.The range of finance functions that can be outsourced includes bookkeeping, payroll processing, tax preparation, financial reporting, and accounts receivable management.

Various industries, from healthcare to retail and manufacturing, commonly utilize these services to optimize their financial processes and improve overall productivity.

Benefits of Outsourcing Finance Functions

Outsourcing finance functions offers numerous advantages for both small and large businesses. For small firms, the cost savings can be substantial, as outsourcing allows them to avoid hiring full-time staff and investing in expensive software. Larger companies benefit from access to a broader range of expertise and resources.Examples of cost savings associated with outsourcing finance tasks include reduced overhead costs and the elimination of the need for in-house software maintenance.

Furthermore, outsourcing enables companies to concentrate on core business activities, leading to better efficiency and innovation.

Challenges of Outsourcing Finance Functions

Despite its benefits, outsourcing finance functions presents potential risks. Common challenges include data security issues, lack of control over financial processes, and dependency on third-party vendors. Industries such as healthcare face unique challenges due to stringent regulatory requirements, while tech companies may struggle with fast-paced changes in financial technologies.To mitigate these challenges, businesses should be aware of common pitfalls such as inadequate vendor selection and failure to establish clear communication channels.

Developing a comprehensive outsourcing strategy can help avoid these risks.

Business Innovation Through Finance Outsourcing

Outsourcing finance functions can drive business innovation by freeing up resources for strategic planning and development. Companies like Slack and Dropbox have successfully innovated their financial processes through outsourcing, allowing them to focus on product development and customer engagement.To foster innovation while outsourcing finance tasks, businesses should encourage collaboration between internal teams and external service providers. This collaboration can lead to fresh ideas and more efficient financial practices.

Impact on International Business

The impact of outsourcing finance functions on international business operations is profound. Cross-border outsourcing plays a crucial role in global finance, enabling companies to tap into new markets and diversify their service offerings.Current trends in international finance outsourcing include the increasing reliance on technology-driven solutions and the growth of shared service centers. These trends have significant implications, as businesses must adapt to a rapidly evolving financial landscape to remain competitive.

Interviewing Finance Outsourcing Experts

When interviewing finance outsourcing professionals, it’s essential to ask questions that uncover their expertise and experience. Key questions include inquiries about their approach to managing financial tasks, their understanding of relevant regulations, and how they ensure data security.Finding the right finance outsourcing partner involves assessing their track record and ability to align with your business goals. Expertise in managing finance functions through outsourcing is critical for a successful partnership.

Job Search Techniques in the Outsourcing Sector

For job seekers looking for roles in finance outsourcing companies, understanding the skills and qualifications in demand is vital. Essential skills include proficiency in accounting software, analytical thinking, and strong communication abilities.Trends in hiring practices for finance outsourcing positions often emphasize the need for candidates to demonstrate flexibility and adaptability in a rapidly changing environment.

Business Management in Outsourced Environments

Managing outsourced finance functions effectively requires adherence to best practices. Establishing clear performance metrics and maintaining quality control are essential for ensuring that outsourced tasks meet company standards.Effective communication with outsourcing partners can be achieved through regular updates, feedback sessions, and leveraging technology to facilitate collaboration.

Marketing Directly to Outsourcing Clients

Creating a marketing strategy for finance outsourcing services involves emphasizing key selling points such as cost savings, specialized expertise, and enhanced efficiency. Successful marketing campaigns in the outsourcing industry often highlight client testimonials and case studies that showcase proven results.

Building a Business Network in Outsourcing

Networking opportunities for professionals in the finance outsourcing field include industry conferences, online forums, and local business events. Establishing connections with potential outsourcing clients can lead to valuable partnerships and growth opportunities.Networking plays a crucial role in developing outsourcing partnerships, as it fosters relationships that can lead to collaboration and shared success.

Enhancing Business Productivity through Outsourcing

Outsourcing finance functions can significantly enhance business productivity. For instance, companies that have outsourced their bookkeeping have reported substantial time savings, allowing them to allocate resources to growth-oriented activities.To measure productivity gains from outsourcing, businesses can track performance metrics such as turnaround times and output quality before and after implementing outsourcing strategies.

Risk Management in Finance Outsourcing

Risk management is paramount when outsourcing finance functions. Various types of risks include data breaches, compliance failures, and reliance on vendor stability. Implementing robust risk mitigation techniques, such as thorough vendor assessments and continuous monitoring, can help manage these risks effectively.

Sales Management in the Outsourcing Context

Finance outsourcing can influence sales management strategies by providing analytical insights from outsourced finance teams. Techniques for monitoring sales performance in outsourced finance environments include utilizing real-time data analytics and regularly reviewing key performance indicators (KPIs).Successful sales management practices often involve maintaining open lines of communication between in-house sales teams and outsourced finance personnel to ensure alignment and accuracy in financial reporting.

Training for Sales and Finance Teams in Outsourcing

Training requirements for sales and finance teams in an outsourcing arrangement focus on enhancing collaboration and understanding between teams. Continuous training and development are crucial for keeping outsourced teams up to date with industry standards and practices.Resources for training programs should include workshops, online courses, and certifications tailored to finance outsourcing.

Security Considerations in Finance Outsourcing

Security risks associated with outsourcing finance functions can be significant, given the sensitive nature of financial data. Best practices for ensuring data security in finance outsourcing include implementing strict access controls, conducting regular audits, and utilizing encrypted communication channels.Compliance with industry regulations is vital for managing security in outsourced finance operations, as failure to comply can lead to severe penalties and reputational damage.

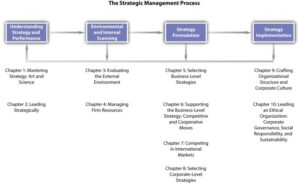

Strategic Planning for Outsourced Finance Functions

Creating a strategic plan for businesses considering outsourcing finance involves identifying key components such as scope, objectives, and performance metrics. A well-defined strategic plan can serve as a roadmap for successful outsourcing initiatives.Success stories of organizations that excelled through strategic outsourcing decisions often emphasize the importance of aligning outsourcing goals with overall business strategies.

Team Building in an Outsourcing Environment

Building cohesive teams that include outsourced finance personnel requires intentional efforts to foster collaboration and trust. Best practices for team building include regular team-building activities, joint training sessions, and creating opportunities for informal interactions.Cultural alignment is crucial in team-building efforts, as it helps bridge the gap between in-house and outsourced teams, fostering a unified organizational culture.

Workplace Communication in Outsourcing

Effective workplace communication in outsourced finance functions can be achieved through clear protocols and the right technology tools. Utilizing platforms that facilitate real-time communication and collaboration is essential for maintaining alignment between teams.Successful communication practices often involve regular check-ins, updates on project statuses, and open channels for feedback.

Workplace Safety in Outsourced Finance Environments

Workplace safety is paramount in finance outsourcing settings, particularly for remote or hybrid teams. Implementing safety protocols includes ensuring that remote teams have secure work environments and access to necessary resources.Guidelines for ensuring compliance with safety regulations in outsourcing should encompass training on data security, health standards, and emergency procedures.

Trends in the Restaurant Industry and Finance Outsourcing

The restaurant industry is increasingly utilizing finance outsourcing to improve efficiency and reduce costs. Commonly outsourced finance functions in restaurants include payroll processing, accounts payable, and inventory management.Case studies of successful restaurants that have benefited from finance outsourcing often highlight enhanced financial reporting and improved cash flow management as key advantages.

Crafting Resumes and Cover Letters for Outsourcing Roles

Creating effective resumes for finance outsourcing positions involves highlighting relevant skills, experience, and accomplishments. Key elements to include in cover letters are a clear expression of interest in the position and a demonstration of how your background aligns with the needs of the employer.Examples of standout resumes in the outsourcing industry showcase quantifiable achievements and emphasize adaptability in dynamic environments.

Retail Sector and Finance Outsourcing

The impact of finance outsourcing on the retail industry is significant, as it allows retailers to streamline their financial operations and reduce operational costs. Specific benefits for retail businesses include improved accuracy in financial reporting and enhanced cash flow management.Case studies of successful finance outsourcing in retail often illustrate how companies have leveraged outsourcing to respond quickly to market changes and customer demands.

Venture Capital and Outsourcing Finance Functions

The relationship between venture capital firms and finance outsourcing is essential for startups seeking to scale efficiently. Outsourcing can help these companies manage their financial processes while allowing them to focus on product development and market entry.Insights into financial management practices in venture-backed companies that outsource often highlight the importance of maintaining agility and leveraging specialized expertise to drive growth.

End of Discussion

In conclusion, outsourcing finance functions presents an exciting opportunity for businesses to enhance their operational efficiency and drive innovation. By navigating the challenges and leveraging the benefits of outsourcing, organizations can position themselves for success in an increasingly competitive market while ensuring that their financial management is in capable hands.

General Inquiries

What types of finance functions can be outsourced?

Commonly outsourced finance functions include bookkeeping, payroll processing, tax preparation, accounts payable and receivable, and financial analysis.

How does outsourcing finance help reduce costs?

Outsourcing often leads to significant cost savings by eliminating the need for in-house staff, reducing overhead expenses, and providing access to specialized expertise without the associated costs.

What are some risks of outsourcing finance functions?

Potential risks include data security concerns, loss of control over financial processes, and dependency on third-party providers, which can impact service quality if not managed properly.

How can businesses ensure effective communication with outsourcing partners?

Establishing clear communication protocols, utilizing collaborative tools, and scheduling regular check-ins can enhance communication and foster a strong working relationship with outsourcing partners.

What industries benefit the most from finance outsourcing?

Industries such as retail, hospitality, and technology often reap significant benefits from finance outsourcing, as they require specialized financial expertise and flexible management of financial operations.